Hilton Grand Vacations reports strong 2018 results

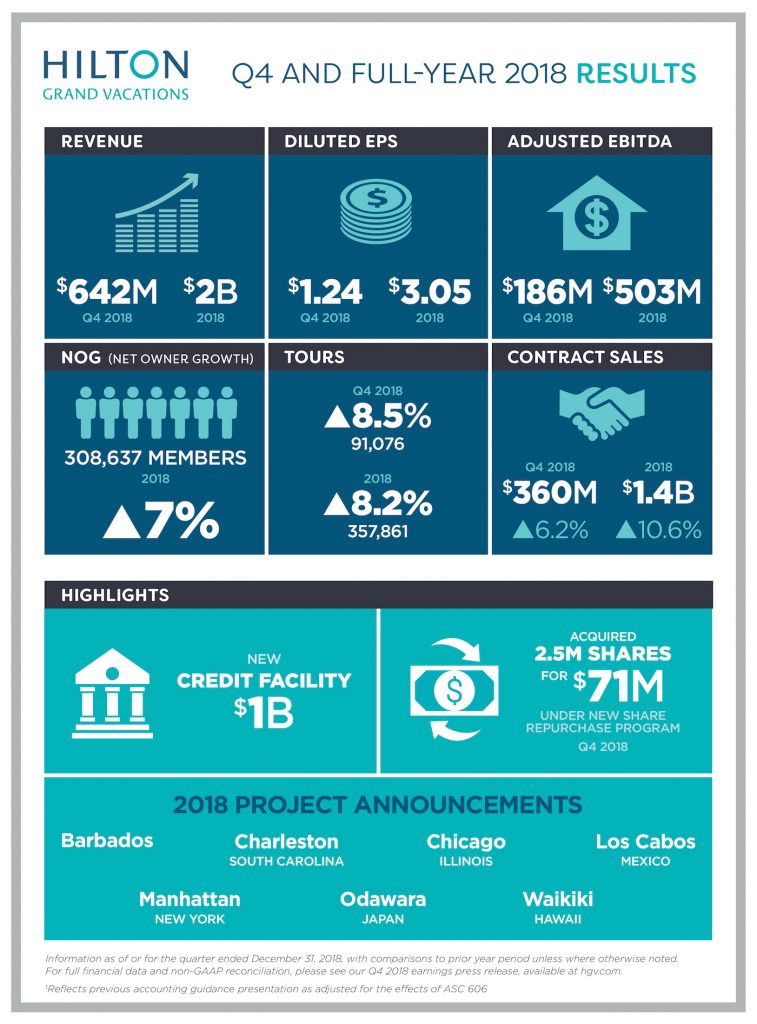

Global timeshare giant Hilton Grand Vacations (HGV) has reported strong full-year and fourth-quarter 2018 results, with net owner growth up by seven per cent for the year.

The report’s highlights include:

Full-Year 2018 Results

- Total revenues were $2.0 billion, net income was $298 million and diluted EPS was $3.05.

- Adjusted EBITDA was $503 million, which was at the high end of guidance. Adjusted EBITDA includes a $79 million net benefit from recognitions related to sales that occurred prior to 2018.

- Contract sales increased 10.6 per cent and Net Owner Growth (NOG) was 7.0 per cent.

- Adjusted free cash flow was ($44) million.

- Increased credit facility to $1 billion and announced $200 million share repurchase authorization.

- Repurchased 2.5 million shares for $71 million under the new authorization at an average price of $28.62.

Outlook

- Increasing diluted EPS guidance to $2.74 to $2.89 from $2.68 to $2.84 to reflect fourth quarter 2018 share repurchases.

- Net income is projected to be between $260 million and $275 million.

- Adjusted EBITDA is projected to be between $450 million and $470 million.

- Contract sales are projected to increase 9.0 to 11.0 per cent.

- Adjusted free cash flow is projected to be between $60 million and $120 million.

- 2019 outlook assumes no construction-related deferrals, recognitions or additional share repurchases.

Overview – Full-Year 2018

Mark Wang, HGV’s president and CEO, said: “2018 was a remarkable year as we saw seven per cent NOG growth and double-digit contract sales and Adjusted EBITDA growth.

“More importantly, we successfully put in place a pipeline of high-return projects in high-demand markets to accelerate our growth in 2019 and beyond. With our recent project announcement, Maui joins Japan, Charleston, Cabo, Chicago and Barbados on the roster of exciting new destinations we’ve announced over the past 15 months.

“We believe our strong 2018 results and the long-term outlook we shared at our recent Investor Day demonstrate HGV’s ability to continue our momentum and drive long-term value for our shareholders.”

For the year ended Dec. 31, 2018, total revenues were $2.0 billion compared to $1.7 billion for the year ended Dec. 31, 2017. Diluted EPS was $3.05 for the year ended Dec. 31, 2018, compared to $3.28 for the year ended Dec. 31, 2017. Net income and Adjusted EBITDA was $298 million and $503 million, respectively, for the year ended Dec. 31, 2018, compared to $327 million and $395 million, respectively, for the year ended Dec. 31, 2017.

Net income and Adjusted EBITDA for the year ended Dec. 31, 2018, included a $79 million net benefit from recognitions related to sales at The Residences property that occurred prior to 2018 that were deferred until the second quarter of 2018 when construction of that project was completed.

Net income for the year ended Dec. 31, 2017, included a deferred income tax benefit of $129 million, which was mostly attributable to a benefit of $132 million for the quarter ended Dec. 31, 2017, related to the one-time re-measurement of net deferred income taxes under the new U.S. federal income tax rate provided by the Tax Cuts and Jobs Act of 2017.